Students are often divided up for statistical purposes. When they apply to school, they may be asked to select a race/ethnicity. They will be asked for their geographic location and parental income. While they are at school, various offices will be categorize them by gender, roommate preferences, degree progress, and major.

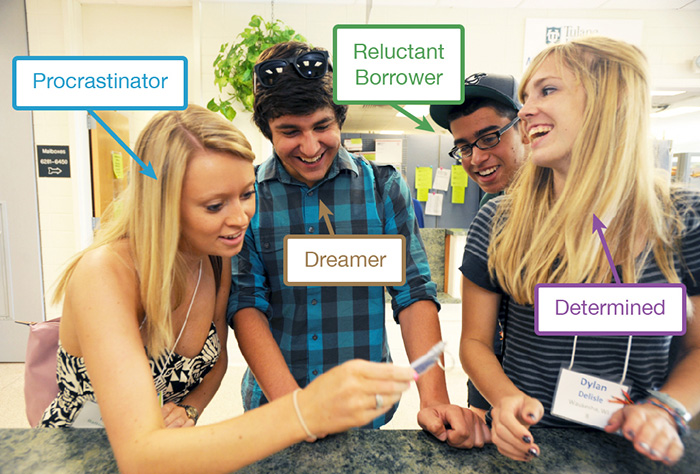

Sallie-Mae, a large American student-loan company, would like to add another flavor to that mix. In their yearly survey of tuition sources, they have come up with a new set of categories (see p. 7). These describe the various types of family that attend college, and they are not particularly flattering. Although the report notes that respondents “generally show[ed] agreement about the value of a college education” (p. 15), their levels of preparedness to pay were quite different. Here is an outline sketch of the report’s categories (for more details, see p. 15-17):

- “Procrastinators” do not have a long-term plan for college. They often attend community colleges, rely on income rather than savings to pay tuition, and often must take out loans;

- “Dreamers” believe that college is the new American Dream. They are more likely to be low-income and are hopeful that a degree will help them climb the socio-economic ladder. They are more likely to attend a four-year college than the “Procrastinators”, but they otherwise are similar in tuition sources;

- “Reluctant borrowers” are similarly optimistic about the value of a degree, but they have savings. They do not want to take out loans in order to pay tuition, even if that means attending a less-prestigious institution; and finally,

- “Determineds” are committed to degree attainment and are willing to pay more and borrow heavily. They are also more likely to have saved significant amounts towards a student’s education.

So this is all very well and good, and I don’t doubt that the authors of this report put a certain amount of care into crafting these categories. But when you look at these descriptions a little more closely, there is a disturbing undertone.

Let’s start with the obvious: semantics. “Procrastinator”? Bad. We don’t want to procrastinate; we want to achieve. “Dreamer” is also a little snide; again, it suggests a lack of achievement. Contrast this with “determined”, which has echoes of grit (which I’ve mentioned before) and success. If you don’t believe me, here are the top three Google results for each of these terms (leaving out the ‘reluctant borrower’, because it just returns articles relating to this report, and dictionary entries):

- “Procrastinator”: wikipedia.org (“doing more pleasurable things in place of less pleasurable ones”; “may result in … social disapproval”); lifehacker.com (”procrastinators waste too much time”); mindtools.com (“find out why you procrastinate and how you can stop!”)

- “Dreamer”: imdb.com (entry for a movie in which a bored housewife-writer is injured and believes she has become her heroine; many others in search); motherjones.com (article denouncing inequity); and a number of songs by different bands (sample lyrics: “I’m dumb and I’m trusting” — and this is actually representative)

- “Determined”: boldanddetermined.com (“the websitsite for winners”); worklesssmilemore.com (a poster with a motivational quote); imdetermined.org (a State of Virginia website on helping disabled students become more independent)

Okay, so the categories are a bit mean. What is not mentioned in this report, aside from the descriptions above, is economic differences. How many of the “determineds” are in the top income bracket? I’d bet nearly all. “Reluctant borrowers” have remarkably similar concerns to the middle class. And the remaining two categories, which are noted as low-income families, seem differentiated largely due to academic motivation.

Why does this matter? Well, stereotypes in general should be used with caution. This is even more true when we’re talking about a company that provides loans to 30 million people. And these are often private loans that come with fewer federal protections. Even in the case of federal loans, issues crop up.

I am not going to chastise Sallie Mae (if you want to know more about student loan scandals in the US, you can check out their Wikipedia page). But I do want to argue that their “categories” are not helpful — they don’t give any new information about the US collegegoing population — and they may be harmful, in that they unduly stigmatize members of non-elite economic groups. At a time when elite education is under fire, is being practical really a poor life decision? Instead of dividing students into discrete categories, maybe it would be better to treat them equally — both inside and outside the classroom.

About the Author: Jaclyn Neel is a visiting Assistant Professor in Ancient History at York University in Toronto, Ontario.